10000 Savings Challenge

The 10 000 Savings Challenge is a personal finance strategy aimed at helping individuals save $10,000 over a specified period, often one year.

This challenge encourages disciplined saving by breaking down the significant goal into manageable daily, weekly, or monthly amounts. Participants typically start by setting a clear savings goal, creating a detailed budget, and identifying areas where they can cut expenses.

By following a structured plan and staying committed, individuals can build a substantial financial cushion, fostering better financial habits and a sense of accomplishment. please stay with Aseemoon.

What is 10k savings challenge?

The 10k savings challenge is a personal finance strategy where participants aim to save $10,000 over a designated period, commonly 12 months. This structured approach helps break down the significant goal into manageable monthly, weekly, or daily savings targets.

Why is the 10000 savings challenge?

The $10,000 Savings Challenge helps individuals build financial stability by encouraging yearly systematic savings. It promotes disciplined financial habits, effective budgeting, and reducing unnecessary expenses. Participants stay motivated and improve their financial health by breaking down the goal into manageable steps.

How Does the Challenge Work?

The $10,000 Savings Challenge breaks down your savings goal into manageable daily, weekly, monthly, and yearly goals. Participants begin by setting a clear goal of saving $10,000 within a specified period.

Focusing on these smaller, more achievable amounts allows participants to easily track their progress and stay motivated. In the rest of this article, you will learn the different methods of saving $10,000 daily, weekly, monthly, and yearly. It might seem like a big goal, but saving $10,000 in one year is possible with these strategies(+).

10000 / 365| 10000 Savings Challenge in 365 Days

The $10,000 Savings Challenge in 365 days involves saving a set amount daily to reach the goal within a year. Let’s calculate the daily savings needed to reach the $10,000 goal in 1 year:

$10,000 ÷ 365 days = $27.40 per day

So, to save $10,000 in 1 year, you must set aside approximately $27.40 daily.

Biweekly 26 week money challenge $10000

The $10,000 Biweekly 26 Week Money Challenge involves saving a specific amount every two weeks to reach the goal within a year. Here’s a breakdown of the timeline:

Biweekly Savings Plan for 10k savings challenge:

- Every 2 weeks, save: $384.62

- Total savings period: 26 weeks

- Total savings goal: $10,000

Biweekly Savings Schedule:

- Week 1-2: Save $384.62

- Week 3-4: Save $384.62

- Week 5-6: Save $384.62

- Week 7-8: Save $384.62

- Week 9-10: Save $384.62

- Week 11-12: Save $384.62

- Week 13-14: Save $384.62

- Week 15-16: Save $384.62

- Week 17-18: Save $384.62

- Week 19-20: Save $384.62

- Week 21-22: Save $384.62

- Week 23-24: Save $384.62

- Week 25-26: Save $384.62

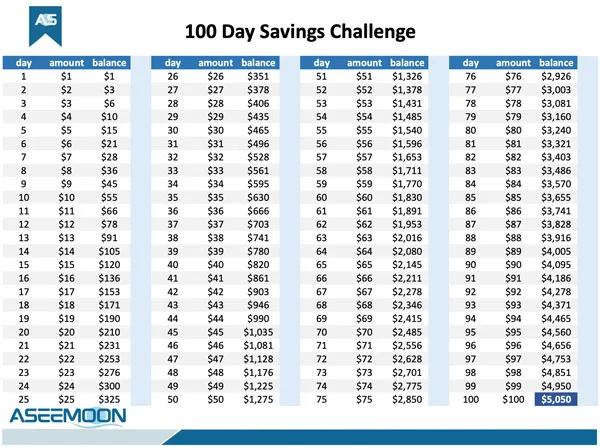

10 000 savings challenge in 100 days

- Total Savings Goal: $10,000

- Timeframe: 100 days

- Daily Savings: $100

Sample Saving $10,000 in 100 days to help you stay on track:

- Day 1-20: Save $100 per day

- Day 21-40: Save $105 per day

- Day 41-60: Save $110 per day

- Day 61-80: Save $115 per day

- Day 81-100: Save $120 per day

10k in 100 days (10k savings challenge) requires discipline, sacrifice, and hard work. Stay focused, and you’ll be on your way to reaching your goal!

How to Save 10k in 3 Months

The $10,000 savings challenge in 3 months! That’s an aggressive goal, but you can make it happen with a solid plan. Here’s a breakdown of the timeline:

Week 1-4 (Month 1): Save $2,500

- Week 1: Save $625

- Week 2: Save $625

- Week 3: Save $625

- Week 4: Save $625

Week 5-8 (Month 2): Save $3,000

- Week 5: Save $750

- Week 6: Save $750

- Week 7: Save $750

- Week 8: Save $750

Week 9-12 (Month 3): Save $4,500

- Week 9: Save $1,125

- Week 10: Save $1,125

- Week 11: Save $1,125

- Week 12: Save $1,125

How to save 10000 in 6 months

Saving $10,000 in 6 months requires discipline and a solid plan. Here’s a breakdown of the timeline:

- Total Savings Goal: $10,000

- Timeframe: 6 months

- Monthly Savings: $1,667

- Bi-Weekly Savings: $833

- Weekly Savings: $417

- Daily Savings: $59

How to save 10000 in a year

To save $10,000 in one year, do the following:

| Month | Savings Goal | Cumulative Savings |

|---|---|---|

| 1 | $833 | $833 |

| 2 | $833 | $1,666 |

| 3 | $833 | $2,499 |

| 4 | $833 | $3,332 |

| 5 | $833 | $4,165 |

| 6 | $833 | $4,998 |

| 7 | $833 | $5,831 |

| 8 | $833 | $6,664 |

| 9 | $833 | $7,497 |

| 10 | $833 | $8,330 |

| 11 | $833 | $9,163 |

| 12 | $837 | $10,000 |

Set a Timeline for the 10000 savings challenge

Timeframe: 1 Year (12 Months)

Month 1: Foundation and Assessment

- Goal Setting: Clearly define your savings goal (e.g., emergency fund, down payment, etc.) and the specific amount you need to save ($10,000).

- Budgeting: Create a detailed budget, tracking your income and expenses. Identify areas where you can cut back.

- Savings Plan: Determine a monthly savings target (approximately $833 per month for a 12-month timeframe).

- Automate Savings: Set up automatic transfers from your checking account to your savings account.

- Motivation Boost: Start a savings journal, create a vision board, or find an accountability partner.

Month 2-3: Early Momentum

- Consistent Savings: Stick to your monthly savings target, even if it initially feels challenging.

- Habit Building: Integrate saving into your routine, making it a regular part of your financial management.

- Review and Adjust: Reevaluate your budget and savings plan. Based on your progress and spending habits, make adjustments as needed.

- Celebrate Small Wins: To stay motivated, acknowledge your achievements, and even save a few extra dollars.

Month 4-6: Building Momentum

- Increased Savings: As you gain confidence and see progress, consider slightly increasing your monthly savings target.

- Side Hustle Exploration: If needed, explore side hustles or freelance opportunities to boost your income.

- Financial Education: Learn about budgeting, saving, and investing to enhance financial literacy.

- Financial Wellness: Focus on reducing debt, if applicable, to free up more money for savings.

Month 7-9: Midpoint Evaluation

- Progress Check: Assess your savings progress and make any necessary adjustments to your plan.

- Motivation Refresher: Revisit your goals and vision board to rekindle your enthusiasm.

- Financial Review: Consult a financial advisor to review your savings strategy and explore investment options.

- Share Your Success: Share your progress with friends or family to stay accountable and inspire others.

Month 10-12: Final Push

- Sustained Savings: Maintain your consistent savings habit, even if you get closer to your goal.

- Goal Visualization: Visualize achieving your savings goal and its positive impact on your life.

- Financial Planning: Start planning how to use your savings once you reach your goal.

- Celebrate Your Success: Acknowledge your accomplishment and reward yourself for your hard work and dedication.

Track Your Progress

Regularly review your savings progress to stay motivated and make adjustments as needed.

10000 savings challenge printable tools:

The 10000 Savings Challenge printable’s free downloadable files are available on the Aseemoon website, accessed through the following links.

10000 savings challenge printable – image

10000 savings challenge printable – excel

Conclusion

The 10k savings challenge is a strong way to achieve financial security, bridging major financial goals. Anyone can set achievable goals, work out a well-itemized savings plan, and stay focused in their quest to save $10,000 within a year.

Initiating it may be challenging, but breaking it into more manageable steps makes it achievable. The rewards of financial security and peace of mind are well worth the effort.

Finally, consider the new financial goals you want to achieve once the 10000 Savings Challenge is completed, such as investing in a 401 for retirement. Prepare yourself to achieve the ultimate long-term target of financial success with a continuous improvement and disciplined saving approach.