Imagine an extra $20,000 just sitting there in your bank account. Consider the peace of mind and opportunities that would bring. No matter what your goal might be, whether starting an emergency fund, paying off debt, or just making the money needed to reach a monumental objective, the 20000 savings challenge will help you reach it.

$20,000 may seem like a lot to save, but breaking it down into smaller bits will help you realize it. An elaborate plan increases the probability of achieving a target. Now, let’s get into the step-by-step guide to saving $20,000.

Step 1: Set a Timeline for the 20000 savings challenge

First, Decide how long you would like to save for $20,000.

For example, do you want to do this in one year, two years, or even three years? This will then affect how much you must save each month. Therefore, in the 20000 Savings Challenge, the savings amount should be divided among the months.

Short-term vs. Long-term Savings Goals

- Short-term (1 year – 12 months): $20,000 / 12 = $1,667 per month

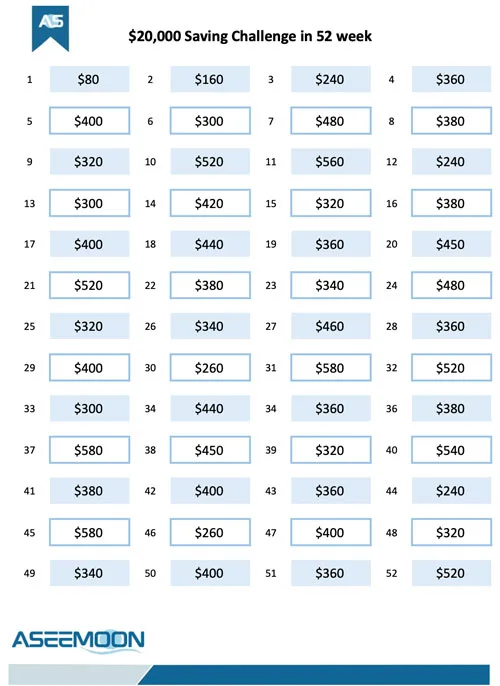

- Short-term (1 year – 52 weeks): 20,000 should be divided into 52 weeks irregularly.

- Medium-term (2 years – 24 months): $20,000 / 24 = $834 per month

- Long-term (3 years – 36 months): $20,000 / 36 = $556 per month

Step 2: Create a Budget

Analyze your current income and expenditure pattern. Cut down unnecessary expenses and save as much as possible. Track your monthly spending to find out the areas of overspending.

Categories to Analyze:

- Housing (rent/mortgage, utilities)

- Transportation (gas, maintenance, public transit)

- Food (groceries, dining out)

- Subscriptions and memberships

- Entertainment and leisure

- Miscellaneous (clothing, gifts, etc.)

Step 3: Automate Your Savings

Establish regular transfers from checking to savings so that savings accumulate incrementally without access to spending temptation.

Action Steps:

- Decides the transferred amount each on a monthly/bi-weekly basis.

- Set up the automatic transfer on your online banking system.

Step 4: Increase Your Income

Look for opportunities to boost your income. This can help you reach your savings goal faster.

Ideas:

- Freelancing or part-time job

- Selling unused items

- Investing in stocks, bonds, or mutual funds

- Rental income (Airbnb, renting a room, etc.)

Step 5: Reduce Unnecessary Spending

Try cutting down on unnecessary expenses. It doesn’t sound a lot, but small changes will definitely add up over time.

Tips:

- Cook at home more often

- Cancel unused subscriptions

- Buy generic brands

- Avoid impulse purchases

Step 6: Track Your Progress

Regularly review your savings progress to stay motivated and make adjustments as needed.

20000 savings challenge printable tools:

Free downloadable files for the 20000 savings challenge printable are available on the Aseemoon website and can be accessed through the following links.

20000 savings challenge printable – image

20k savings challenge printable – excel

20000 savings challenge free printable pdf

Step 7: Stay Motivated

Saving money is one of the most popular our life’s resolutions. But less than a third (31%) of us keep all our self-promises for 12 months, according to research by YouGov.

Accomplishing a challenge that deals with a large sum of money, such as the 20k Savings Challenge, requires one to be disciplined and motivated. If you divide the $20,000 down into monthly targets, you can think about the ultimate goal and celebrate the small ones: your first thousand bucks or when you have reached the midpoint.

Stay committed by tracking and adjusting your budget where needed. Remember that every little bit brings you closer to that financial goal and the attainment of rewards for your hard work.

Motivation Tips:

- Visualize your goal (create a vision board)

- Reward yourself for hitting smaller savings milestones

- Share your goal with friends or family for accountability

Sample 20k Savings Challenge Plan for One Year

Monthly Savings Goal: $1,667

| Month | Savings |

|---|---|

| January | $1,667 |

| February | $1,667 |

| March | $1,667 |

| April | $1,667 |

| May | $1,667 |

| June | $1,667 |

| July | $1,667 |

| August | $1,667 |

| September | $1,667 |

| October | $1,667 |

| November | $1,667 |

| December | $1,667 |

| Total | $20,004 |

FAQs

- How can I save money if I have a low income?

- Start small and increase your savings bit by bit. Look at your expenditure, see what costs you can cut, and how to increase your income with side hustles.

- What should I do if I miss a savings target in the 20000 savings challenge?

- There is nothing to get discouraged about—look at the budget, adjust the plan, and try again. Flexibility and persistence come in handy here.

- Is it better to save or invest my money?

- You will first create an emergency fund from savings, and later, using part of these savings, you will research investments that will help grow money over the long.

- Can I save $20,000 faster in the 20k savings challenge?

- Yes, you can cut more expenses, increase your income, and maybe even invest wisely. Just be wary of investments, lest they come to be excessively risky.