50/30/20 Budget Template Google Sheets

If you are looking to learn how to implement the 50/30/20 budgeting method in Google Sheets, this article is for you. Please stay with Aseemoon.

50/30/20 budget template Google Sheets: It can feel overwhelming to manage one’s finances at times, but with the right tools and strategies in place, it can be very doable. A rule of thumb, and arguably one of the most popular and practical budgeting strategies, is to divide your income strategically into three portions:

50% for needs, 30% for wants, and 20% for savings and debt repayment. This straightforward and effective framework ensures the ability of an individual to take good care of essential expenses, have a good lifestyle, and save for their future.

Related: The amazing 50/30/20 Budget: A Step-by-Step Guide

Today, in the wake of digitization, tools like Google Sheets will help you ease the budgeting process. It is fitted with flexibility and openness to a platform where one can create and customize a budget template in correspondence with financial goals.

This will show you how to create a 50/30/20 budget template in Google Sheets so you know with clarity and confidence where you stand as you take control of your finances. Whether you’re an absolute beginner at budgeting or would like to hit the refresh button on the system in place, this guide will help give you an ideal platform from which you can manage your finances effectively.

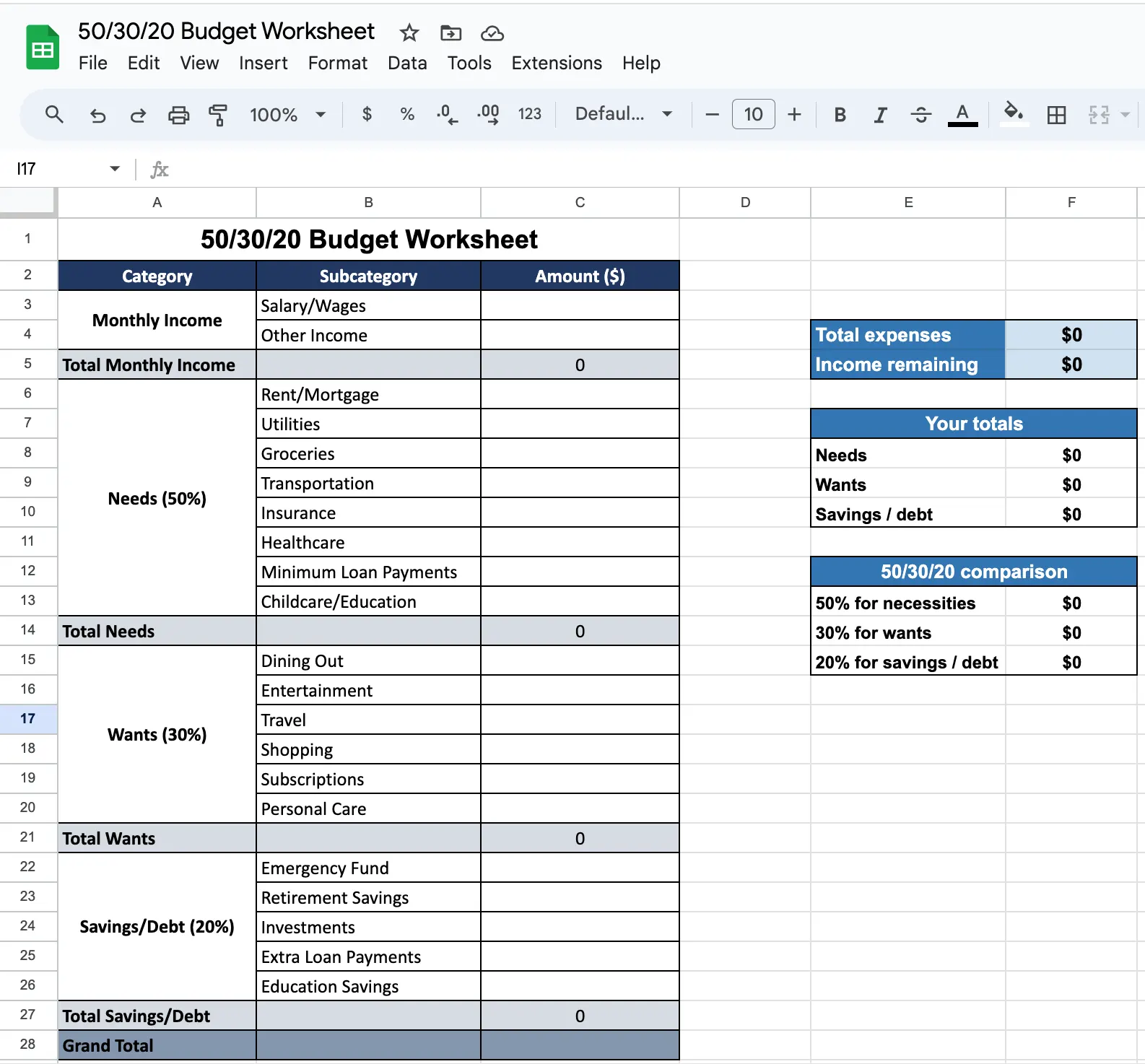

50/30/20 budget template Google Sheets

Step 1: Open Google Sheets

- Go to Google Sheets.

- Click on the “Blank” option to create a new spreadsheet.

Step 2: Set Up the Sheet

- Title the Sheet: Click on the “Untitled spreadsheet” box at the top left and rename it to something like “50/30/20 Budget Worksheet”.

- Rename Sheet Tab: Double-click on the “Sheet1” tab at the bottom and rename it to “Budget”.

Step 3: Create Headers

- In row one, place the table title, for example, the 50/30/20 budget template (A1).

- In row 2, create the following headers starting from cell A2:

- A2: Category

- B2: Subcategory

- C2: Amount ($)

Step 4: Define Budget Categories and Subcategories

- Under the “Category” column, list your monthly income and 50/30/20 budget categories (Needs, Wants, Savings/Debt).

- Under the “Subcategory” column, list your budget categories starting from cell B3. You can categorize them into Monthly Income, Needs, Wants, and Savings/Debt Repayment. For example:

- Monthly Income:

- B3: Salary/Wages

- B4: Other Income

- Needs:

- B6: Rent/Mortgage

- B7: Utilities

- B8: Groceries

- B9: Transportation

- B10: Insurance

- B11: Healthcare

- B12: Minimum Loan Payments

- B13: Childcare/Education

- Wants:

- B15: Dining Out

- B16: Entertainment

- B17: Travel

- B18: Shopping

- B19: Subscriptions

- B20: Personal Care

- Savings/Debt:

- B22: Emergency Fund

- B23: Retirement Savings

- B24: Investments

- B25: Extra Loan Payments

- B26: Education Savings

- Monthly Income:

Step 5: Add Totals Row

- In rows 5, 14, 21, and 27, create “Total” rows:

- A5: Total Monthly Income

- A14: Total Needs

- A21: Total Wants

- A27: Total Savings/Debt

Step 6: Calculate Monthly Income, Needs, Wants, and Savings/Debt Amounts

- In the “Amount” column, enter your income or budgeted amounts for each category.

- To calculate the total monthly income amount, use a SUM formula in cell C5:

- C5:

=SUM(C3:C4)

- C5:

- To calculate the total needs amount, use a SUM formula in cell C14:

- C14:

=SUM(C6:C13)

- C14:

- To calculate the total wants amount, use a SUM formula in cell C21:

- C21:

=SUM(C15:C20)

- C21:

- To calculate the total Savings/Debt amount, use a SUM formula in cell C27:

- C27:

=SUM(C22:C26)

- C27:

Step 7: Calculate Total expenses

-

In cell E4, write “Total expenses,” and in the adjacent cell, F4, place the sum of the budget amounts, which includes the total for wants, needs, and savings/debt. In cell F4, enter:

- F4:

=C14+C21+C27

- F4:

Step 8: Calculate the Income remaining

-

In cell E5, write “Income remaining,” and in the adjacent cell, F5, place the difference between income and the total budgeted amounts. In cell F5, enter:

- F5:

=C5-F4

- F5:

Step 9: Apply Formatting

- Format Currency: Highlight the “Amount” column, right-click, and select “Format cells” > “Currency.”

Step 10: Save and Share

- Your 50/30/20 budget template is now ready!

- To share, click the “Share” button in the top-right corner and enter the email addresses of those you want to share it with.

Final Template Overview

Your Google Sheets template should now have the following structure:

This template will help you allocate your income effectively, ensuring you follow the 50/30/20 rule for budgeting.

Tips:

- Use conditional formatting to highlight when actual spending exceeds budgeted amounts(+).

- Link directly to your bank or expense tracking apps for real-time updates.

- Regularly review and adjust your budget based on changing financial circumstances.

By following these steps, you can create an effective 50/30/20 budget template Google Sheets to manage your finances and achieve your financial goals.