52 week savings challenge

The 52 Week Savings Challenge is more than just a way to save money—it’s a powerful tool for building better financial habits. In a world where instant gratification often trumps long-term planning, this challenge will teach you patience, discipline, and consistency.

It’s designed to start with small, manageable amounts, making it less daunting and more achievable for those who struggle with saving. Gradually, the savings add up, and you get a big amount at year-end. Plus, it also increases your level of responsibility towards your finances.

Want the best part? Saving money often sounds like an uphill task, but what if there was a way of effortlessly building these savings through fun and structured steps? Enter the 52 Week Savings Challenge! This widely used method of saving money gradually eases your wallet of money over the year so that it feels manageable, even pleasurable.

Understanding the 52 Week Savings Challenge

How Does the Challenge Work?

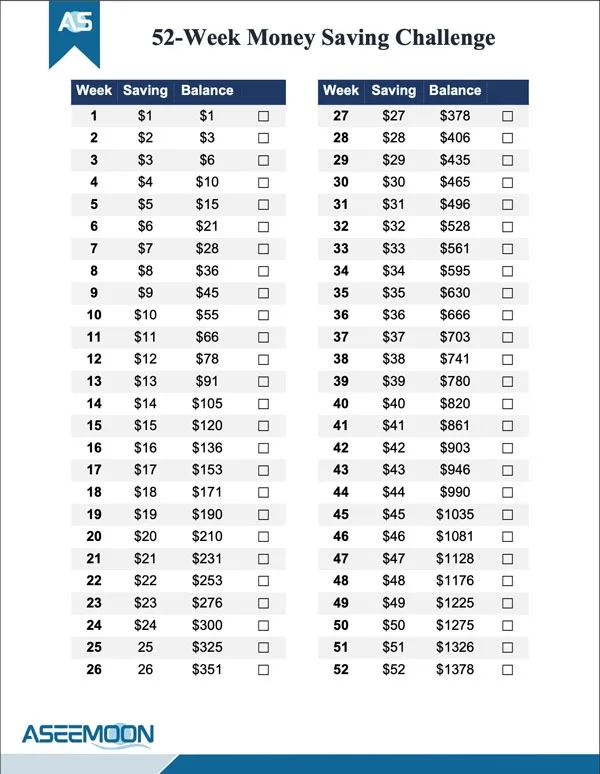

The concept is simple: save small in the first week and gradually increase the amount over time. For example, $1 in week one, $2 in the second week, $3 in week three, and so on. By the end of the 52 weeks, you would have saved quite a chunk of money—$1,378, to be precise!

Benefits of the 52 Week Saving Challenge

- Gradual Increase: It starts little and gradually increases, making it not overwhelming.

- Habit formation: It inculcates the habit of regular saving.

- Achievable Goal: Easy to start and stick with, suitable for all income levels.

Getting Started 52 week money saving challenge

Setting Realistic Savings Goals

First, think of a realistic goal before getting started. How much do you want to save up at the end of the 52 week money saving challenge? Knowing your financial situation will enable you to attain achievable targets.

Tools and Resources Needed

Track your weekly savings by writing down your savings on a notebook, an envelope, or just log it in an online spreadsheet. Some prefer to keep a separate savings account to reduce the temptation of spending the money set aside for this challenge from their other funds.

Note: At the end of this article, a 52 week savings challenge printable is provided for you in an image format and an Excel file (spreadsheet), which is available for free download.

Week-by-Week Breakdown

Weeks 1-13: Building Momentum

In the first quarter, focus on establishing the habit. It is the foundational phase where you are saving very little; hence, it is easily manageable.

Weeks 14-26: Staying Consistent

When it increases, staying consistent becomes important. If possible, automate your savings so you don’t forget to save some money every week.

Weeks 27-39: Overcoming Challenges

In the middle, surprise expenses or motivational drops are some of the barriers that might be encountered. Keep motivated by the end result.

Weeks 40-52: Finishing Strong

Now it’s time for the final stretch of the 52 week savings challenge, and the amount saved is the highest weekly. Take some time to reflect on the progress and maintain enough motivation to finish the challenge.

Tips for Success in 52 week money saving challenge

Staying Motivated

Visuals like a chart representing your progress will keep you more motivated. Sharing this goal with friends or family members for more support will also help.

Adjusting the Challenge to Fit Your Needs

Tailor the challenge more towards your financial situation. If starting at $1 increments is too easy or too hard, do what works best for you. For example, you can add $2 each week or start with $20.

Finding Additional Savings

Look for ways in your daily life that you can cut costs—limit dinner out, cancel subscriptions you never use, or finding discounts on necessary purchases.

Real-Life Success Stories of 52 Week Savings Challenge

Benjamin Franklin’s famous quote about saving is:

“A penny saved is a penny earned.”

Testimonials from Participants

Many people have successfully completed the 52 Week Savings Challenge. Jane from New York shared, “Completing the challenge was life-changing. It taught me discipline and helped me build a safety net.”

Inspirational Outcomes

These stories of success show how powerful this challenge is in bringing out the fact that small, medium, but constant steps have the capability to bring immense financial improvement.

Using Tools to Help You Save

52 week savings challenge printable

On the Aseeman website, a printable Excel file and photo of the 52 Week Savings Challenge are available for download. To download for free, click on the relevant link.

printable 52 week savings challenge – photo

printable 52 week savings challenge – Excel file

52 week savings challenge printable pdf free

FAQs About the 52 Week Savings Challenge

What if I Miss a Week?

Don’t stress! You can make up for it by saving double the next week or spreading the missed amount over several weeks.

Can I Start the Challenge at Any Time?

Absolutely! The challenge can start at any point in the year.

Is the Challenge Suitable for Everyone?

While it’s generally suitable for most people, those with very tight budgets might need to adjust the weekly increments.

How Much Should I Aim to Save?

The standard challenge saves $1,378 in a year, but you can adjust it based on your financial goals and capabilities.

What to Do with the Saved Money?

You can use the savings for emergencies, invest them, or put them towards a specific goal, like a vacation or a big purchase.

Conclusion

The 52 Week Savings Challenge will effectively help to increase people’s savings incrementally, wherein starting small and saving a little more every week, you can build a large financial impact over a year. Be it an emergency fund, a vacation, or better savings habits, this challenge is one of the greatest tools to achieve these. So what are you waiting for? Get started with your 52 Week Saving Challenge now and create a hold on your financial future!