How to Reach Financial Goals?

Achieving financial stability and building wealth requires a structured approach involving clear goal setting, budgeting, saving, investing, and making smart financial decisions. With dedication and proper planning, you can align your income and spending habits with your aspirations, creating a secure financial future. This guide will walk you through the steps required to craft a well-rounded strategy that meets both your short-term needs and long-term dreams. please stay with Aseemoon.

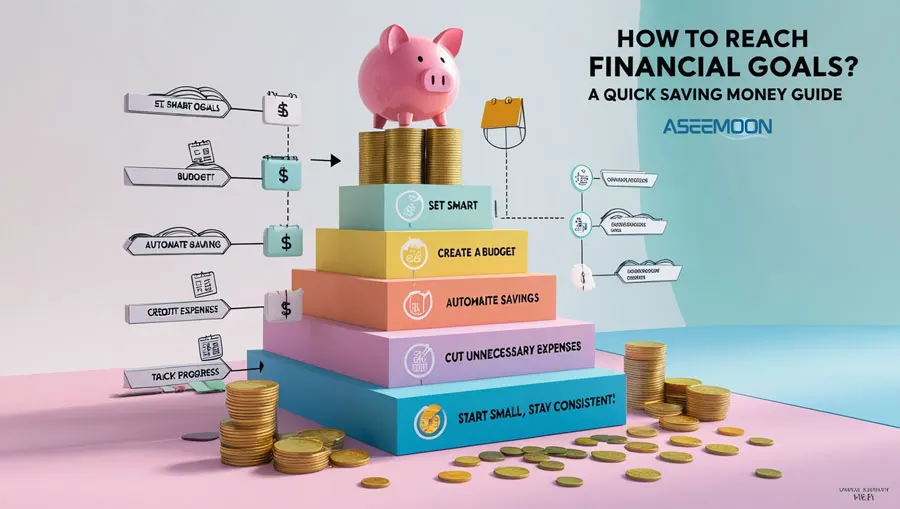

How to Reach Financial Goals? A Quick Saving Money Guide

Section 1: SMART Financial Goals – The Foundation for Success

The first step toward financial success is setting clear, actionable goals. Many people fail in their financial journey by setting vague objectives, such as “I need to save more money.” Instead, stay focused and motivated using the SMART framework—when you set financial goals, they should be specific, Measurable, Achievable, Relevant, and Time-bound.

For example, instead of saying, “I want to save more,” define your goal as:

“Save $10,000 for a home down payment within two years.” This specific target helps you break the process into smaller, actionable steps and tracks progress effectively.

Short-Term vs. Long-Term Goals

- Short-term goals (1 year or less): These are smaller, easily achievable goals like paying off a credit card, buying new equipment, or saving for a vacation. Achieving short-term goals provides quick wins, boosts confidence, and reinforces positive financial habits.

- Long-term goals (5–10 years or more): A long-term financial goal usually requires more time and effort, such as buying a home, funding your child’s education, or preparing for retirement. Long-term goals demand consistent effort, strategic planning, and discipline over time.

Prioritizing Your Goals

Once your goals are defined, prioritize them based on urgency and importance. For example, it might make sense to focus first on paying off high-interest debt before saving for a vacation. Efficient resource allocation ensures your finances aren’t spread too thin, allowing you to achieve meaningful progress.

Setting Realistic Timelines and Milestones

Breaking down large, ambitious goals into smaller, manageable steps keeps you motivated. For example, if your goal is to save $10,000 for a home down payment in two years, set monthly savings targets. Celebrating these milestones helps you stay motivated and prevents burnout.

Section 2: Building a Comprehensive Budget – Take Control of Your Finances

A budget is the foundation of financial management, helping you take control of your spending and saving habits. A well-structured budget ensures that every dollar has a purpose.

Tracking Your Expenses

The first step to creating a budget is understanding your spending patterns. Track all your expenses for at least three months using apps (like Mint or YNAB), spreadsheets, or even a journal. This helps you identify areas where you can reduce unnecessary spending—such as daily coffee purchases or unused subscriptions.

Categorizing and Allocating Your Budget

Divide your expenses into meaningful categories:

- Fixed costs (e.g., rent, utilities, insurance)

- Variable costs (e.g., groceries, entertainment)

- Debt repayments (e.g., credit cards, student loans)

- Savings goals

A helpful starting point is the 50/30/20 rule:

- 50% of your income for essentials

- 30% for discretionary spending

- 20% for savings and debt repayment

However, customize these percentages to suit your situation. For instance, if you’re aggressively paying down debt, you might reduce discretionary spending and allocate more toward loan payments.

Automating Savings and Payments

Set up automatic transfers from your checking account to savings or investment accounts. Automating savings ensures consistency and removes the temptation to spend. Even small, regular deposits can grow significantly over time through the power of compounding.

Section 3: Increasing Income – Expanding Your Financial Goals and Plans Horizons

While budgeting controls your spending, increasing income can fast-track your financial goals. There are multiple ways to boost your earnings:

Negotiating a Raise

Regularly assess your performance and the market value of your role. If you’ve contributed significantly to your organization, prepare a solid case to negotiate a raise by highlighting your measurable achievements. Research industry salaries to make sure your expectations are realistic and data-driven.

Exploring Side Hustles and Freelance Work

Side hustles—like freelancing, consulting, or gig work—can add additional income streams. Choose opportunities that align with your skills and interests to make the job more enjoyable. For example, if you’re skilled in graphic design or coding, freelancing can offer a lucrative side income.

Investing in Skill Development

Continuously upgrading your skills can open new career opportunities and boost your long-term earning potential. Consider taking online courses or certifications that align with your career path. Skill-building is a long-term investment often resulting in higher salaries and greater job security.

Section 4: Making Smart Financial Decisions – Strategic Choices for Success

Smart financial decisions form the backbone of long-term financial security. Here are key strategies to help you stay on track:

Aggressively Manage Debt

Paying off high-interest debt (like credit cards) should be a top priority. Interest payments can erode your wealth over time, so use the Debt Avalanche Method (paying off the highest-interest debt first) or the Debt Snowball Method (paying off smaller debts first) to build momentum.

Build an Emergency Fund

An emergency fund acts as a financial safety net. Aim to save 3–6 months’ living expenses in a high-yield savings account. This fund ensures you’re prepared for unexpected events, like medical emergencies or job loss, without taking on debt.

Strategic Investments for Long-Term Growth

Once your emergency fund is in place, invest in low-cost index funds or ETFs. These diversified investments offer steady, long-term growth with relatively low risk. If you’re new to investing, consider consulting a financial advisor to align your investments with your goals and risk tolerance.

Section 5: Staying Motivated – Achieve Financial Goals

Staying motivated on your financial journey is critical, especially when progress feels slow. Here are a few ways to maintain momentum:

Visualize Your Success

Create a vision board with images representing your financial goals, such as a dream home or vacation. Review your goals regularly to keep them fresh in your mind. Visualizing success strengthens your commitment to the process.

Celebrate Milestones

Acknowledge and celebrate small achievements along the way. For example, if you reach a savings milestone or pay off a debt, treat yourself to a small reward. Celebrating milestones keeps you motivated and reinforces positive behavior.

Seek Accountability and Support

Share your financial goals with friends, family, or a financial advisor. Accountability partners can offer encouragement and help you stay on track. Conversations with others who have similar goals can also provide valuable insights and motivation.

Section 6: Adapting to Life Changes – Flexibility in Financial Planning

Life is unpredictable, and your financial situation may evolve. Flexibility in your financial plan allows you to adapt to changing circumstances.

Regular Budget Reviews

Revisit your budget periodically to ensure it reflects your current goals and financial realities. Adjust your savings, spending, and debt repayment strategies as needed. For example, if you receive a raise, consider increasing your savings contributions rather than raising your lifestyle expenses.

Preparing for Major Life Events

Anticipate and plan for major life events, such as marriage, starting a family, or retirement. Setting aside funds in advance for these milestones reduces financial stress when they arrive.

Conclusion: Achieving Your Financial Goals

Achieving your financial goals requires a comprehensive, structured approach. By setting clear goals, building a realistic budget, increasing your income, and making smart financial decisions, you’ll create a solid foundation for long-term success.

Remember that consistency, discipline, and regular reviews are key to staying on track. Life will present challenges, but with flexibility and persistence, you’ll be better prepared to handle unexpected events.

Don’t hesitate to seek professional financial advice when needed. Advisors can provide personalized guidance to help you navigate complex financial decisions. With careful planning, steady effort, and smart choices, you can achieve financial freedom and secure a bright future for yourself and your family.