Monthly Saving Challenge

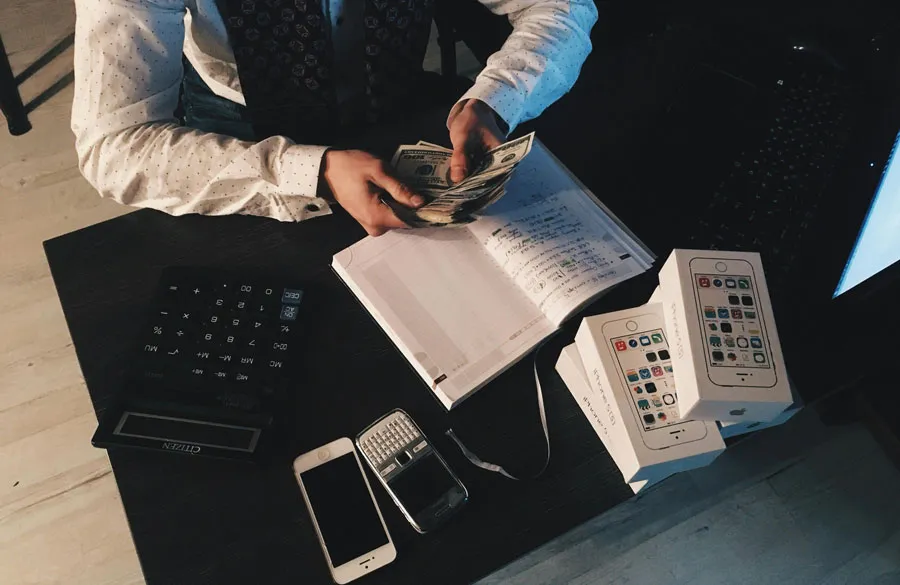

Monthly saving challenges have become very popular and practical in the modern world. They aim at financial stability and give a clear route to financial success, greatly motivating people to save more regularly.

Saving has never been more crucial than in 2024, with the economy highly uncertain and the cost of living increasing. From building an emergency fund to saving for that special purchase, these creative, accessible monthly saving challenges will help you secure a healthier financial future—no matter your budget. Please stay with Aseemoon.

why is the Monthly Saving Challenge important?

The Monthly Savings Challenge outlines ways to build financial discipline and promote a proactive savings culture. Establishing the obligation to save a certain sum of money each month establishes a well-structured system through which an individual can accumulate money over time.

This habit not only prepares one for unexpected expenses but also allows one to develop the culture of setting money aside for future holidays, emergencies, or major purchases. Besides, it is realistic and helps one keep count of the progress, hence increasing one’s motivation; it may remind us why we need financial stability in our daily lives. By embracing habits like Saving for Future, we can be better prepared for tomorrow.

Benefits of Using the Monthly Savings Challenge

This table summarizes how participating in a Monthly Saving Challenge can positively impact your savings habits compared to not participating.

| Scenario | Without Monthly Saving Challenge | With Monthly Saving Challenge |

|---|---|---|

| Savings Consistency | May lack a structured approach, leading to inconsistent savings. | Provides a structured plan for saving consistently each month. |

| Financial Goal Achievement | May struggle to reach financial goals due to a lack of discipline. | Helps you systematically save towards achieving specific financial goals. |

| Savings Routine Development | Fewer chances to develop strong savings habits. | Encourages the development of a disciplined savings routine. |

| Handling Unexpected Expenses | Higher risk of financial stress or debt due to insufficient savings. | Builds a financial cushion that can help manage unexpected expenses more easily. |

| Motivation and Reward | Less motivation to save regularly, which may affect your overall savings progress. | Motivates the challenge, and a sense of accomplishment upon completion. |

How Do the Monthly Savings Challenge?

There are two main types of monthly saving challenges:

1-Incremental Monthly Saving Challenge: A savings plan where you start with a small amount and increase your monthly savings.

2-Goal-Oriented 30-Day Saving Challenge: A savings plan to reach a specific financial goal within a month.

The Incremental Monthly Saving Challenge and the Goal-Oriented 30 Day Saving Challenge are effective strategies for building savings, but they cater to different financial needs and motivations. Here’s a deeper look at each type:

Monthly Saving Challenge

The Incremental Monthly Saving Challenge is designed to help individuals gradually increase their savings over time. Participants start with a small amount and increase their monthly savings, which can help them build a habit of saving without overwhelming them.

How It Works:

- Starting Amount: Choose a small initial amount to save in the first month (e.g., $10).

- Incremental Increase: Increase the amount saved by a set increment (e.g., $10 more each month) each subsequent month.

- Total Savings: By the end of the year, participants can save a significant amount without feeling the pinch of a large upfront commitment.

Example Breakdown:

- January: $10

- February: $20

- March: $30

- April: $40

- May: $50

- June: $60

- July: $70

- August: $80

- September: $90

- October: $100

- November: $110

- December: $120

Total Savings: $780 by the end of the year.

Benefits:

- Gradual Habit Formation: Helps participants develop a consistent saving habit.

- Manageable Increases: The incremental approach makes it easier to adapt to increased savings over time.

- Sense of Achievement: Participants can see their monthly savings grow, boosting motivation.

30 day savings challenge

The Goal-Oriented 30-Day Saving Challenge focuses on achieving a specific financial goal within a month. This challenge is ideal for those looking to save for a particular purpose, such as a vacation, a new gadget, or an emergency fund.

How It Works:

- Set a Specific Goal: Determine a clear financial target (e.g., save $300 for a weekend trip).

- Daily Savings Plan: Break down the total amount into daily savings goals or identify areas to reduce spending.

- Track Progress: Monitor daily savings to stay motivated and accountable.

Example Breakdown:

If the goal is to save $300 in 30 days:

- Daily Savings: Save $10 each day.

- Alternatively, participants can identify specific expenses to eliminate (e.g., skipping a daily coffee or lunch out).

Benefits:

- Focused Motivation: A specific goal can drive motivation and commitment to saving.

- Quick Results: Achieving a goal in a short timeframe can provide immediate gratification and a sense of accomplishment.

- Flexibility: Participants can adjust their daily savings based on their financial situation and priorities.

Monthly Saving Challenge Guide

Saving money can be challenging, but breaking it down into a monthly goal can make it more manageable. Here’s a simple guide to a 12-month saving challenge that can help you save systematically:

Month 1: Evaluate and Plan

- Goal: Identify your financial goals and set a savings target.

- Action: Track your expenses for a month to understand your spending habits. Create a budget that includes a dedicated savings amount.

Month 2: Cut Unnecessary Expenses

- Goal: Find areas where you can reduce spending.

- Action: Cancel unused subscriptions, limit dining out, and reduce impulse purchases. Allocate the saved money to your savings account.

Month 3: Automate Savings

- Goal: Make saving effortless.

- Action: Set up an automatic transfer from your checking account to your savings account each month.

Month 4: Sell Unused Items

- Goal: Declutter and earn extra money.

- Action: Sell items you no longer need or use on platforms like eBay, Craigslist, or through a garage sale. Save the proceeds.

Month 5: Reduce Utility Bills

- Goal: Lower household expenses.

- Action: Implement energy-saving measures, such as using energy-efficient bulbs, unplugging devices, and adjusting your thermostat. Save the difference.

Month 6: Cook at Home

- Goal: Save on food costs.

- Action: Plan meals and cook at home more often. Use a grocery list to avoid buying unnecessary items. Save the money you would have spent eating out.

Month 7: Review Subscriptions

- Goal: Eliminate redundant or unnecessary services.

- Action: Review all your subscriptions and memberships. Cancel those you don’t use regularly. Redirect this money to savings.

Month 8: DIY Month

- Goal: Save on services by doing things yourself.

- Action: Try DIY projects for home repairs, beauty treatments, or gifts. Save the money you would have spent on professional services.

Month 9: Use Cash Back and Rewards

- Goal: Maximize benefits from your spending.

- Action: Use cash-back credit cards or reward programs for your regular purchases. Transfer the rewards or savings into your savings account.

Month 10: No-Spend Challenge

- Goal: Curb unnecessary spending.

- Action: Commit to a no-spend month on non-essential items. Only spend on necessities like groceries and bills. Save the money you would have spent on extras.

Month 11: Increase Income

- Goal: Boost your savings with extra earnings.

- Action: Look for side gigs or freelance work. Use your skills to earn additional income. Deposit this money directly into your savings.

Month 12: Review and Reflect

- Goal: Assess your progress and plan for the future.

- Action: Review your financial status and savings progress. Set new savings goals for the next year and adjust your budget accordingly.

Monthly Savings Challenge Printable

A printable monthly savings challenge helps people manage their financial lives towards the achievement of set savings goals. This attractive worksheet shows transparent goals for saving for each passing month, thereby helping to keep track of one’s progress.

printable monthly savings challenge will help one in setting up a proper saving routine, enhancing financial discipline, and growth in the money saved. Both beginners and experienced savers have a great challenge that makes saving enjoyable and rewarding. In this section, a printable monthly savings challenge is presented:

monthly savings challenge printable

Best Ideas for Monthly Saving Challenge

Coffee Shop Swap Challenge

No-Spend Month Challenge

First, list all the necessary fixed living expenses, such as rent and transportation.

Consider critical variables of needs, such as food and other household items.

Try not to buy anything off your list for the whole month.

This challenge will be useful in realizing where unnecessary spending occurs and might potentially save hundreds in one month.

Free Entertainment Month Challenge

- Outdoor activities

- Free local events

- At-home game nights

- Reading library books

This challenge not only helps you save money but also encourages creativity in finding enjoyable, cost-free activities.